⚠️ Disclaimer:

This post reflects my personal opinions and analysis based on publicly available information. I am not a SEBI-registered advisor. Please consult a certified financial expert before making any investment decisions.

Flat Opening Expected Amid Mixed Global Cues

The Indian stock market is expected to open on a flat note on May 6, 2025, as indicated by the GIFT Nifty trading around its previous close. While positive cues from Asian markets and the GIFT Nifty suggest early optimism, the weak closing of the Nasdaq and broader US markets might cap any significant upward momentum.

Key highlights:

- GIFT Nifty is hovering near the previous day’s close.

- Nasdaq’s dip may limit bullish enthusiasm.

- US tariffs continue to influence inflation and global trade.

- Derivatives suggest a neutral-to-slightly-bearish stance for Nifty.

- Stock-specific action expected in Tata Steel, SBI, Kotak Bank, and M&M.

Global Economic Landscape: Tariffs Keep Inflation on the Radar

US Tariff Impact on Global Inflation

The United States’ tariffs remain a persistent threat to global economic growth. As of the first week of May 2025, consumer inflation expectations are on the rise due to increased input costs in imported goods. This has led to the steepest rise in goods prices in over two years.

Central bank responses:

- US Fed is likely to hold interest rates steady.

- Bank of England might consider a rate cut due to slowing economic growth.

This divergence reflects varying economic pressures and adds to market volatility globally.

US Market Performance – May 5, 2025

- Dow Jones: -0.2% (41,218.83)

- S&P 500: -0.6% (5,650.38)

- Nasdaq: -0.7% (17,844.24)

After a nine-day winning streak, the markets dipped due to:

- Profit booking.

- Anticipation around the Federal Reserve meeting.

- Ongoing tariff-related uncertainties.

Notable movements:

- Berkshire Hathaway fell after Buffett’s exit news.

- Zimmer Biomet dropped ~12% due to tariff-related profit warnings.

GIFT Nifty Update: Flat to Slightly Positive Opening Signaled

As of 7:30 AM IST on May 6, 2025, the GIFT Nifty was trading at 24,560.

- Indicates range-bound volatility and cautious optimism.

Derivatives Market Outlook

FII and DII Cash Market Activity – Strong Institutional Support

| Date | FII Net (₹ Cr) | DII Net (₹ Cr) |

|---|---|---|

| May 5, 2025 | +497.79 | +2788.66 |

| May 2, 2025 | +2769.81 | +3290.49 |

| Apr 30, 2025 | +50.57 | +1792.15 |

| Apr 29, 2025 | +2385.61 | +1369.19 |

The consistent buying by both FIIs and DIIs signals strong institutional confidence in the market’s upside potential.

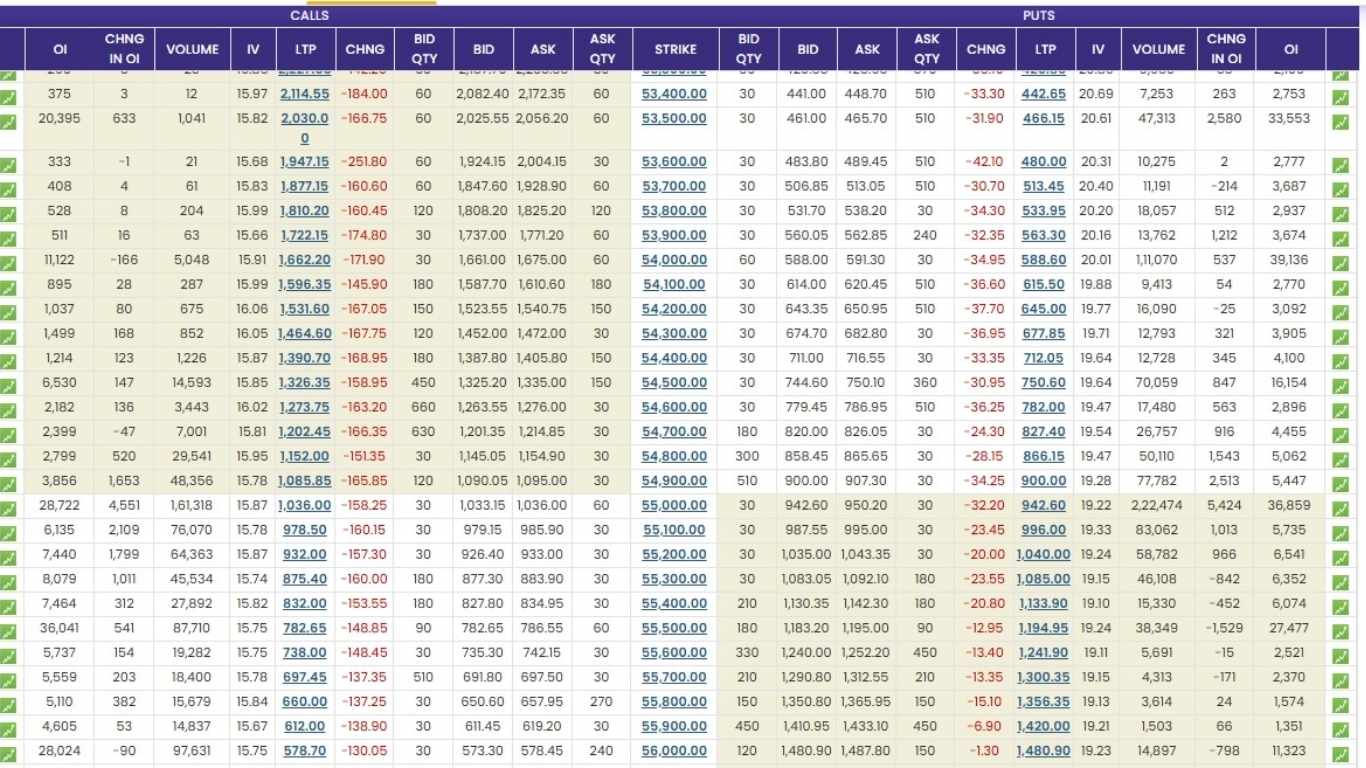

Option Chain Data: Key Resistance and Support Levels

Nifty Option Chain (Expiry: May 8, 2025)

- Call OI (Resistance): 24,500 & 24,60

- Put OI (Support): 24,400 & 24,300, 24,000

Bank Nifty Option Chain

- Call OI (Resistance): 55,000 & 55,500

- Put OI (Support): 54,500 & 55,000. 54,0000

Put Call Ratio (PCR): Slightly Bearish Bias

- Nifty PCR: Indicates mild bearish sentiment.

- Bank Nifty PCR: Reflects neutral sentiment.

These ratios suggest limited aggressive positioning, aligning with a cautious outlook.

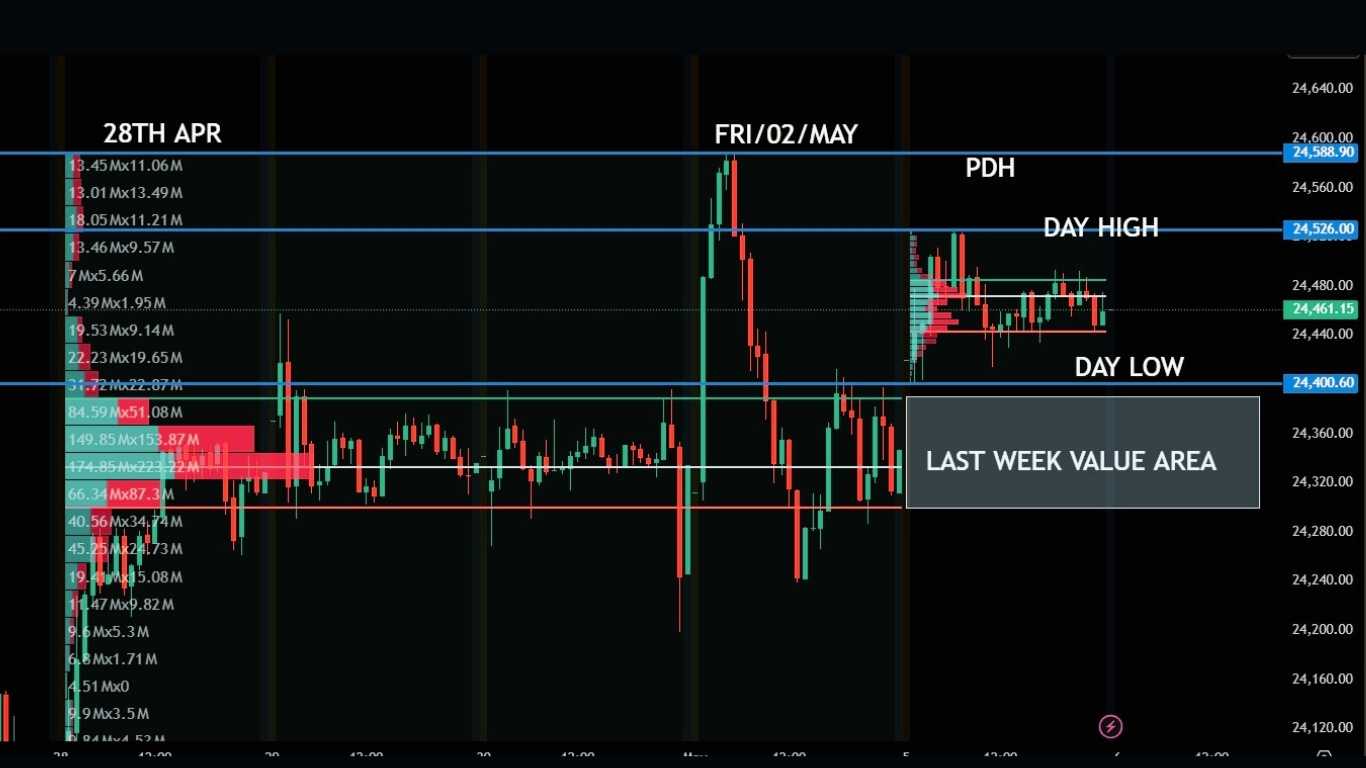

TECHNICAL ANALYSIS:

BANK NIFTY is slightly moving out of value area of the last week, which might be a negative sign. the support and resistance are marked in the given fig. the POC AND YESTERDAY HIGH MIGHT BE RESISTANCE FOR TODAY MARKET.

looking at yesterday chart, the support is at 24,400 which was also previously act as resistance. between 24,300 to 24,400 , value area which might act as a support. resistance, yesterday high and previous day high.

Conclusion

The Indian stock market pre-market report for May 6, 2025, points to a flat-to-positive open with mixed global cues, strong institutional backing, and cautious derivative setups.