Pi Network Trading Strategy: 90% Success Rate with Trendline Breakouts

1. Introduction: Pi Network Trading Strategy

Today, I’ll share how the Pi Network has been trading since its launch. I’ll also reveal one strategy that works 90% of the time.

We’ve all seen the Pi Network’s volatility and volume. Most traders know the risks and potential. Higher risk can mean higher returns. But that doesn’t mean we should take random risks.

We need to analyze the chart and find what works. followed by Backtesting.

Disclaimer:

Trading is risky. What I’m sharing is my personal opinion. Both the risk and the profit are entirely yours. so, trade smart or blame your mouse, not me!

Pi Network Trading Fundamentals: The Key to a 90% Success Rate Strategy

Before jumping into the 90% success rate Pi Network trading strategy, it’s essential to understand two major factors that shape your trading — volatility and trading volume.

Volatility: Why Pi Network Moves Like a Roller Coaster (Fundamental Analysis)

In trading, volatility refers to how quickly and by how much an asset’s price changes. And when it comes to Pi Network, the price swings are no joke. We’ve seen it drop 20% in a day and jump 25% the next—which is unusual compared to most other asset classes.

So, why is Pi Network so volatile? Here are the main reasons:

- Market Sentiment and Speculation: Prices react to hype and fear—when people get excited, the price spikes; when doubt creeps in, it crashes.

- Developmental Stage: Pi Network is still evolving, and uncertainty always adds to price instability.

- Broader Crypto Market Influence: When major coins like Bitcoin move, smaller coins often follow, whether it wants to or not.

Understanding volatility is key because any Pi Network trading strategy needs to account for these rapid shifts. You don’t want to be caught off guard when the market moves against you.

Trading Volume: The Market’s Pulse (Fundamental Analysis)

Trading volume tells you how much of an asset is being bought and sold—and in Pi Network, this can fluctuate wildly across different exchanges. Not every exchange offers smooth trading, so liquidity can be a challenge. I will explain later about liquidity under risk management.

Why does volume matter in your Pi Network trading strategy?

- High Volume = More Action: When trading volume spikes, it means there’s strong interest of buyer or seller and more opportunities.

- Low Volume = Risky Moves: Thin trading means fewer buyers and sellers, making it harder to enter or exit trades.

If you want to master a high-success Pi Network trading strategy, watch the volume closely—it can give you valuable clues about market direction.

The good news? More people are accepting Pi Network, and new exchanges are starting to list it—which means more liquidity and better trading opportunities.

Up next—we’ll reveal the exact strategy and how you can start using it today.

Pi Network Trading Strategy That Works 90% of the Time

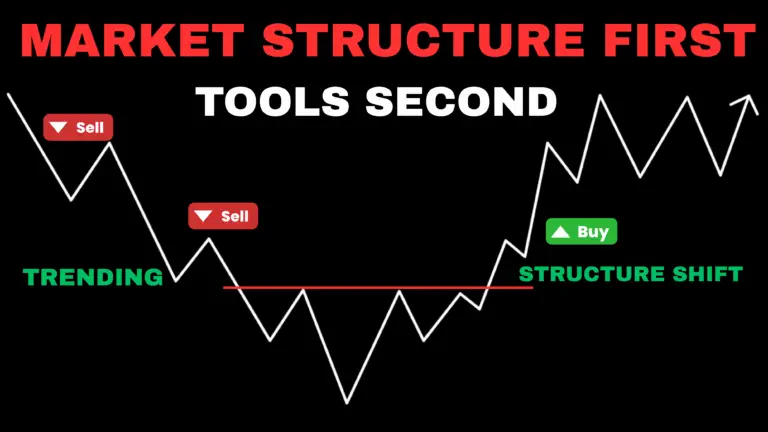

The Pi Network trading strategy we’re using is called the trendline breakout—a simple yet powerful technical analysis method to catch big moves in the market. Let’s break down what a trendline is and how to use it to profit from breakouts.

What Is a Trendline?

A trendline is a straight-line connecting swing highs or swing lows on a price chart. It helps identify the direction of the market—whether it’s going up (bullish) or down (bearish).

Here’s how trendlines work:

- Support Trendline: Formed by connecting three or more swing lows—it acts like a floor where the price bounces up.

- Resistance Trendline: Formed by connecting three or more swing highs—it acts like a ceiling where the price struggles to break through.

When the price breaks above or below these trendlines with strong volume, it often signals the start of a new trend.

Pi Network Trendline Breakout Strategy: Your 90% Success Blueprint

If you’re looking to boost your Pi Network trading game, the trendline breakout strategy might be your best friend. It’s simple, effective, and—when used correctly—can deliver consistent profits.

What Is a Trendline Breakout?

A trendline is a line drawn on a price chart that connects swing highs (peaks) or swing lows (bottoms). It shows the direction a market is moving—either up, down, or sideways.

A trendline breakout happens when the price moves above or below this line, signaling a potential trend reversal or continuation—and that’s where we make our move.

Types of Trendlines:

- Support Trendline: Formed by connecting swing lows—indicates where buyers step in.

- Resistance Trendline: Formed by connecting swing highs—shows where sellers dominate.

When the price breaks through a trendline with strong volume, it often means a big price move is coming.

Why Does This Strategy Work?

The trendline breakout works because it captures the moment when market pressure builds up and explodes in one direction.

Here’s why it’s so powerful:

- Psychology of Breakouts: Traders pile in when a key level is broken.

- Volume Confirmation: Big volume means big interest—no volume, no move.

- Clear Entry/Exit Points: You know when to enter and where to exit.

Pi Network Trendline Breakout Strategy: Key Steps

✅ 1. Identify the Trendline.

- Draw a line connecting at least 3 swing highs or swing lows.

- The more touches, the stronger the trendline.

✅ 2. Wait for the Price to Touch the Trendline at Least 3 Times.

- This confirms the validity of the trendline—no premature entries.

✅ 3. Choose the Right Timeframe:

- 15-Minute Chart: Best for swing trades (holding positions longer).

- 5-Minute Chart: Ideal for intraday trades (quick profits).

✅ 4. Buy on an Upward Breakout with High Volume.

- If the price breaks above the trendline with huge volume, enter a buy position.

✅ 5. Sell on a Downward Breakout with High Volume.

- If the price breaks below the trendline with huge volume, enter a sell position.

✅ 6. Set Your Stop-Loss (Protect Your Capital).

- Intraday: Use a 1:2 risk-reward ratio (risk ₹100 to make ₹200).

- Swing Trade: Go for a 1:5 ratio (risk ₹100 to make ₹500). based on our backtested strategy 1:5 is minimum.

Executing the Trade: Don’t Overthink, Just Trade

This is the most crucial part. It’s normal to get nervous when you place your first trade—but trust me, you’ll get used to it. The rule is simple: Don’t overthink—trade what you see.

I’ve noticed that Pi Network’s price moves crazy fast during breakouts, and it’s easy to miss the opportunity. Here’s how I handle it:

- 1. Use Limit Orders:

- Set a limit order slightly above the trendline for a breakout buy or below the trendline for a breakout sell. This way, your trade gets executed automatically—no panic clicks.

- 2. Wait for the Retracement (If You Miss the Breakout):

- Missed the move? Chill. Wait for the price to pull back to the broken trendline—it often gives you a second shot. Don’t chase the breakout, that’s how you lose money fast.

4. Managing Risks in Pi Network Trading

I thought of wrapping things up with a conclusion, but this guide would be incomplete without discussing risk management and trade management. If you’re still here, I’m grateful for the time you’ve spent with me.

Earlier, I mentioned risk-to-reward ratios, but here’s the truth—it might not work the same way for you. Why? Because we’re two different individuals with different expectations from our trades.

That’s why it’s crucial to ask yourself:

- Who are you as a trader?

- What kind of risks are you willing to take?

Understanding your risk tolerance is the foundation of successful Pi Network trading. Let’s break down how to manage risks effectively while staying profitable.

How to Manage Risks in Pi Network Trading Effectively

Managing risk isn’t just about setting a stop-loss—it’s about understanding your limits and sticking to a plan. Here are some practical steps to protect your capital while trading Pi Network:

✅ 1. Know Your Risk Tolerance

Ask yourself:

- How much am I willing to lose on a single trade?

- Can I handle multiple losses without panicking?

If you’re new, start small. Risking 1-2% of your trading capital on each trade is a safe zone.

✅ 2. Use a Proper Risk-to-Reward Ratio

A good Pi Network trading strategy isn’t just about winning trades—it’s about winning more than you lose.

✅ 3. Set a Stop-Loss—Always

No exceptions. A stop-loss protects you from unexpected price swings. Here’s a simple rule:

- For Breakouts: Set your stop-loss below the breakout candle.

- For Swing Trades: Place it at the previous swing low for long positions and swing high for short positions.

✅ 4. Manage Position Sizes Smartly

Bigger trades = bigger risks. Always calculate your position size based on your capital and risk level.

Understand Leverage and Margin:

- Leverage lets you control a larger position with less money—but it’s a double-edged sword. Higher leverage means higher potential gains but also bigger losses.

- Use leverage cautiously—start small and only increase when you’re confident in your strategy.

✅ 5. Stick to Your Trading Plan

Emotion is your biggest enemy. Whether you win or lose, follow your plan. Consistency beats randomness every time.

By understanding your risk tolerance and applying these risk management strategies, you’ll survive volatile markets and thrive over time.

Executing the Trade: Don’t Overthink, Just Trade

This is the most crucial part. It’s normal to get nervous when you place your first trade—but trust me, you’ll get used to it. The rule is simple: Don’t overthink—trade what you see.

I’ve noticed that Pi Network’s price moves crazy fast during breakouts, and it’s easy to miss the opportunity. Here’s how I handle it:

Missed the move? Chill. Wait for the price to pull back to the broken trendline—it often gives you a second shot. Don’t chase the breakout, that’s how you lose money fast.

1. Use Limit Orders:

Set a limit order slightly above the trendline for a breakout buy or below the trendline for a breakout sell. This way, your trade gets executed automatically—no panic clicks.

2. Wait for the Retracement (If You Miss the Breakout):

Missed the move? Chill. Wait for the price to pull back to the broken trendline, it often gives you a second shot. Don’t chase the breakout, that’s how you lose money fast.

5. Why Backtesting Is Key for Any Pi Network Trading Strategy

Backtesting means testing your Pi Network trading strategy on past price data to see how it would have performed. It helps you spot flaws, refine your approach, and build confidence before risking real money.

In the above chart, we can see that the trendline are showing in the yellow line. here in this particular set up the strategy work 100 percent.

Also notice that if the pi network is in uptrend, then look for buying opportunity. if it down trend then look for selling opportunity. remember trend is your friend.

6. Conclusion: Master Pi Network Trading with a Solid Strategy

Pi Network’s volatility offers big opportunities—but only if you trade smart. The trendline breakout strategy works because it follows real market movements, especially when confirmed by volume.

Key takeaway? Analyze the charts, backtest your strategy, and always manage your risk. With patience and discipline, you’re one step closer to mastering Pi Network trading.

This method may not work all the time because of change in market structure.